revolving open end credit example

A the ability to cover cash flow shortages. Advantages of using credit are all of the following except.

What Is Open End Credit Experian

Using a credit card issued by a store a bank card such as VISA or MasterCard or overdraft protection are examples of.

. Examples of open-ended credit include the following. The minimum income required to qualify for the Card is 20000. Home equity lines of credit HELOCs.

Credit Cards The majority of credit cards offer a revolving credit line. C the ability to buy large items earlier. B increases the number of checks written.

Fee for Balance Transfers. Summary An open credit is a financial arrangement between a lender and a borrower that allows the latter to access credit repeatedly up to a specific maximum limit. 3 of each balance transfer 5 minimum and 50 maximum.

Common examples of revolving credit include credit cards home equity lines of credit HELOCs and personal and business lines of credit. This fee does not apply to balance transfers submitted with this application. With open-end or revolving credit loans are made on a continuous basis as you purchase items and you are billed periodically to make at least partial payment.

An example of revolving credit is the home equity line of credit. In the consumer market home equity loans are an example of an open-end credit which allows homeowners to access funds based on the level of equity in the homes. The most common examples of revolving credit include personal lines of credit home equity lines of credit HELOCs and of course credit cards.

D convenience in making day-to-day transactions. The three most common examples of revolving lines of credit are credit cards personal lines of credit and home equity lines of credit. Once a borrower pays off the 30000 owed the line of credit remains open for re-borrowing later making the line of credit revolving in nature.

With a home equity line of credit or HELOC a home owner can get a line of credit from the bank backed by the home or real estate property given as collateral were the owner can use the amount of credit needed to perform purchases. Revolving Credit Examples. You can begin to build a credit history by using utility services.

The line of credit offered with the Card is up to 100000. This allows borrowers to access as much or as little funds as they chose depending on their current needs.

Revolving Credit Personal Credit Loans Lines Of Credit

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

How Revolving Credit Works Howstuffworks

Understanding Different Types Of Credit Nextadvisor With Time

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Lesson 16 2 Types Sources Of Credit Ppt Download

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Secured Vs Unsecured Lines Of Credit What S The Difference

Revolving Credit Vs Line Of Credit What S The Difference

/GettyImages-1139932365-8f9a8413a3f34b2799375e57efeee64c.jpg)

Revolving Credit Vs Line Of Credit What S The Difference

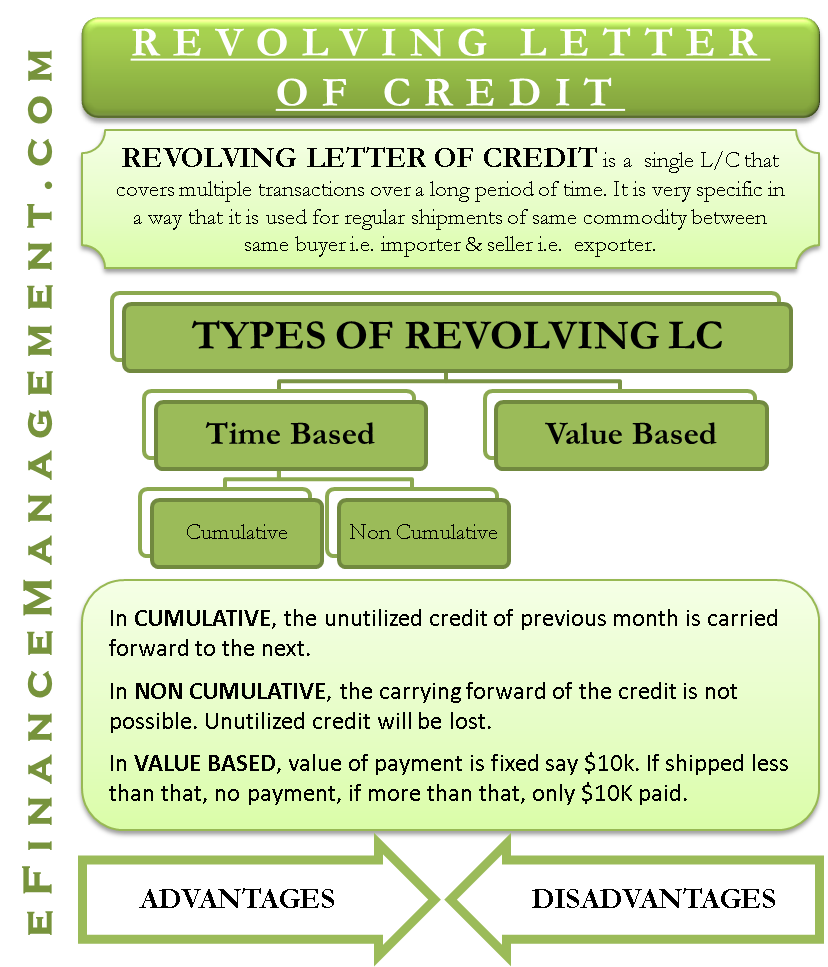

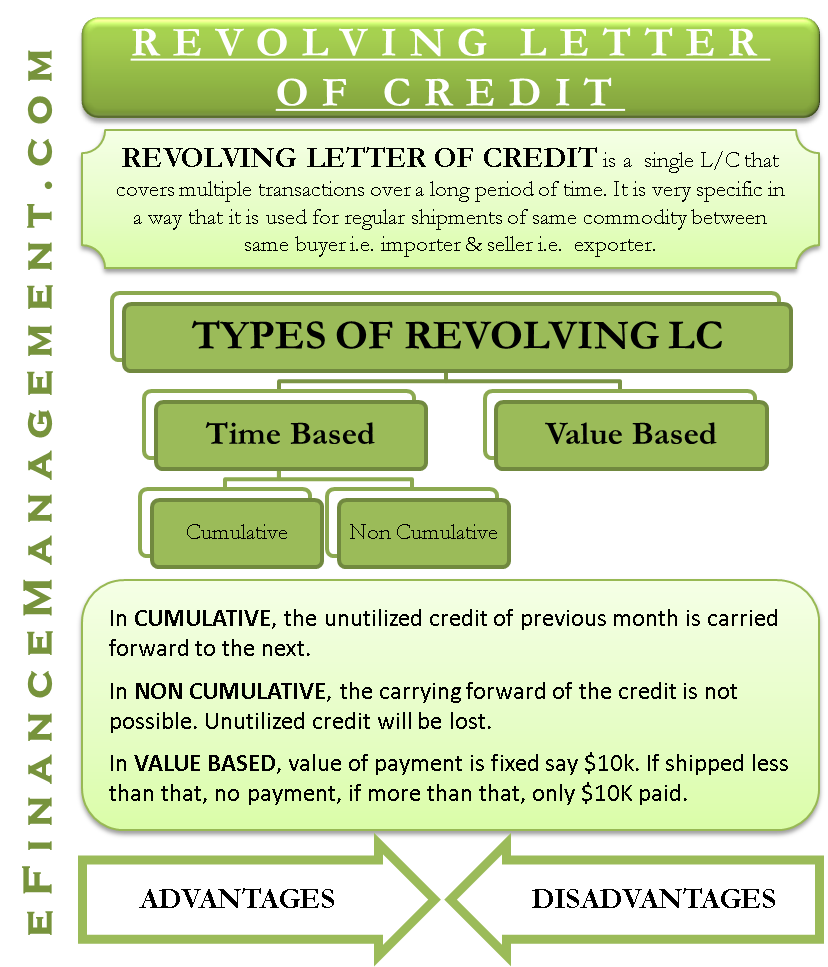

Revolving Letter Of Credit Meaning Types With Example

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Understanding Different Types Of Credit Nextadvisor With Time

What Is A Credit Utilization Rate Experian

Open End Credit Examples Open End Credit This Is A Type Of Credit Loan Paid On Installments In Which The Total Amount Borrowed May Change Over Time Course Hero

What Is Open End Credit How It Works Examples Pros And Cons Cash 1 Blog News

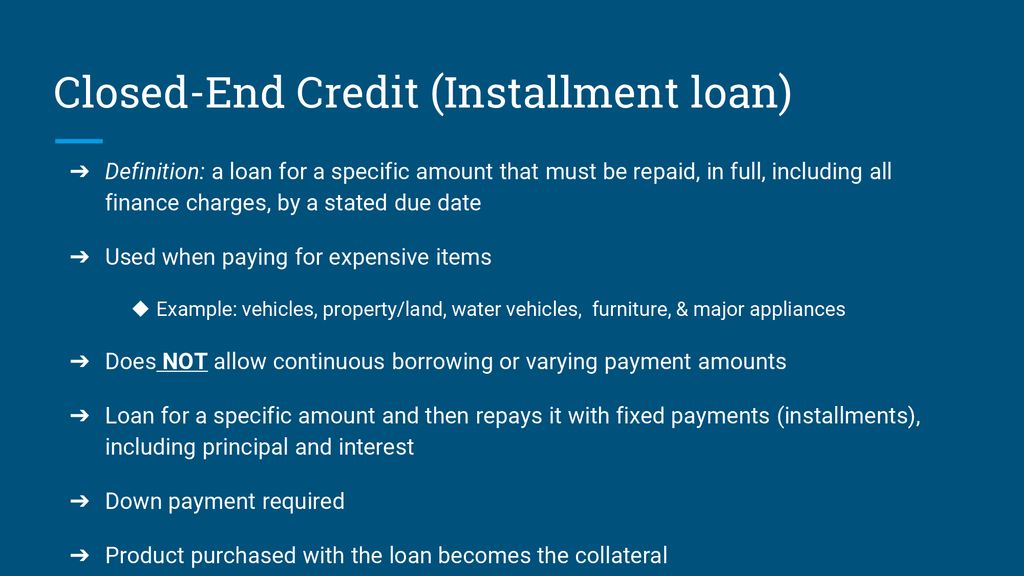

Revolving Credit Vs Installment Credit What S The Difference

Revolving Credit Facility Features Of Revolving Credit Facility

The Difference Between Revolving And Nonrevolving Credit Bankrate